How to Pay off Your House in Less than 5 Years

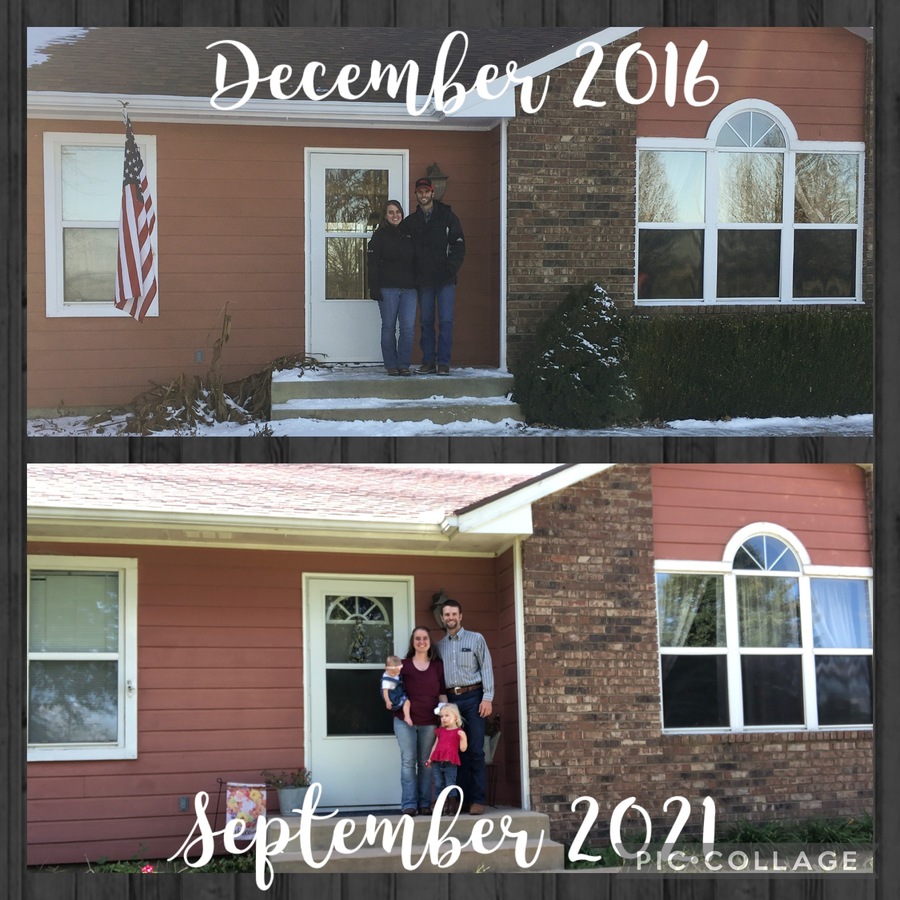

It’s official…we are completely debt free!!! Last week we paid off the mortgage and couldn’t be more excited. Especially since our plan was to pay off the 15yr loan in 7yrs…and we did it in less than 5!!

To be honest, though, I’m still trying to grasp the idea. I mean, it’s not like we had spent YEARS paying on our house. But we never dreamed we would pay it off in such a short amount of time. It was something that we knew would happen and we dreamed about how it would feel. To actually accomplish it is a little surreal though.

So how did we do it?

The process was actually quite simple. First, we saved up a nice down-payment and got a 15yr fixed rate mortgage. While most people are attracted to the lower monthly payments a 30yr mortgage provides, they don’t realize that over 1/2 their payment for the first 10 or so years is interest. It’s not until the mortgage is over halfway complete that principal really starts to drop. In comparison, a 15yr starts with higher principal than interest in each payment and the interest continues to drop as the loan is paid off. At the end of our loan, based on the principal balance, we were paying less than $100/month in interest. So while you may feel like a 30yr mortgage will be easier to pay, it will actually be harder because it takes longer and you’ll end up paying more in interest.

Second, we made sure to keep the monthly payment below 25% of our take home pay and we took every extra dollar we could save or make each month and paid extra. I think I figured up that on average we paid an extra $2,000/month. So yes, when most people were buying a new toy or taking a vacation or remodeling their house, we were paying ours off. It’s super easy and very tempting to only make the minimum payment and use your extra money for other things. But that only delays your ability to actually use your extra money for other things! When I think of how much more freedom and opportunity we have now, plus the amount of interest we saved and will in turn earn through an investment, I can’t imagine how anyone who be comfortable with not paying their house off early!

It’s a concept that most people don’t fully understand. In fact, I didn’t completely understand it until I ran the numbers of our mortgage payment and figured out how much we would make through investing. But the saying is true that your greatest tool to build wealth is your income. So getting out of debt as fast as possible is the most important part of increasing your net worth.

Now, is paying off a house easy? No, not at all. It takes discipline, hard work and a committed focus on the future. But then again, the process IS easy. And I believe you can do it also. To find out how, just book a free consultation and I’ll show you what the banks and your friends don’t want you to know about becoming debt free!